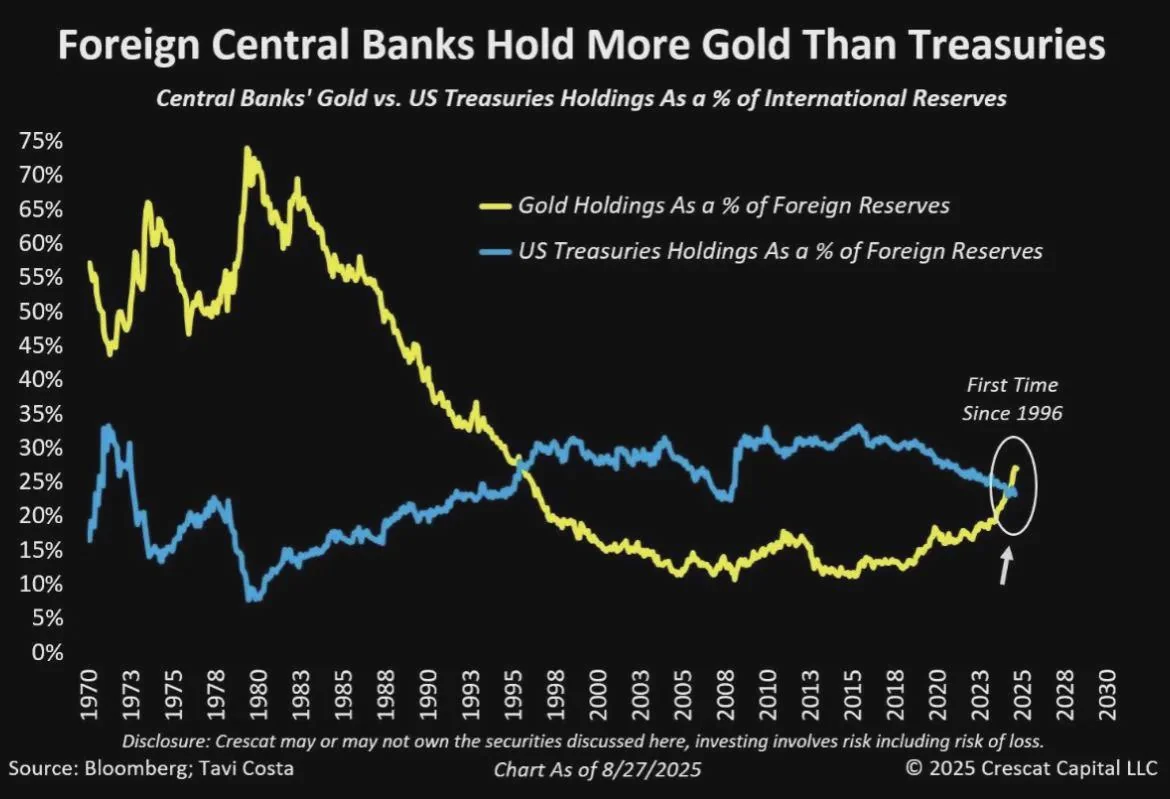

Global reserve managers have crossed a symbolic threshold: for the first time in over three decades, central banks collectively hold more gold than U.S. Treasuries. The shift underscores how fiscal stress, geopolitical fragmentation, and the weaponization of finance are reshaping what official institutions consider “safe” assets.

The preference for bullion over bonds marks a structural change in reserve composition. While the dollar remains dominant, its share of global reserves continues to edge lower, replaced by assets immune to both counterparty and policy risk.

The Numbers Behind the Turn

By late October 2025, central banks held roughly 36,800 tonnes of gold, worth about $4.6 trillion at spot prices near $3,980 an ounce—slightly above their estimated $4.5 trillion in U.S. Treasuries.

The crossover reflects both gold’s 50 percent rise this year and a sustained program of diversification by reserve managers. Central banks have been net buyers of gold for sixteen consecutive years, accumulating 650 tonnes through October 2025, 15 percent more than in the same period a year earlier.

Foreign official holdings of U.S. debt, by contrast, have remained flat since 2022. With total U.S. government debt now exceeding $36 trillion and quarterly issuance surpassing $1.5 trillion, the risk profile of Treasuries has shifted. For many institutions, physical gold now functions as the more reliable long-term store of value.

Who’s Buying

| Country / Region | Gold Purchases (tonnes) | Total Reserves (tonnes) | Context |

|---|---|---|---|

| Poland | +92 | 460 | Targeting 20 % gold share amid euro-zone volatility. |

| China | +225 | 2,300 | Twelfth consecutive year of accumulation; reduced Treasury exposure. |

| India | +72 | 910 | Hedging rupee depreciation; stepped-up buying in Q3. |

| Kazakhstan | +45 | 420 | Expanding buffers against regional currency risk. |

| Turkey | +35 | 540 | High inflation sustaining demand for hard assets. |

| Brazil & others | +181 | ≈1,200 | Broader emerging-market diversification trend. |

Sources: World Gold Council, IMF IFS, national central-bank reports (October 2025 estimates).

Breakdown: Largest Official Holders of Gold

| Rank | Country / Institution | Tonnes | Approx. Market Value ($bn) |

|---|---|---|---|

| 1 | United States (Federal Reserve) | 8,133 | 1,030 |

| 2 | Germany (Bundesbank) | 3,352 | 425 |

| 3 | Italy (Banca d’Italia) | 2,452 | 310 |

| 4 | France (Banque de France) | 2,436 | 308 |

| 5 | Russia (CBR) | 2,330 | 295 |

| 6 | China (PBoC) | 2,300 | 292 |

| 7 | Switzerland (SNB) | 1,040 | 132 |

| 8 | Japan (BoJ) | 846 | 107 |

| 9 | India (RBI) | 910 | 115 |

| 10 | Netherlands (DNB) | 612 | 78 |

| 11 | Turkey (CBRT) | 540 | 68 |

| 12 | Saudi Arabia (SAMA) | 324 | 41 |

| 13 | United Kingdom (BoE) | 310 | 39 |

| 14 | Poland (NBP) | 460 | 58 |

| 15 | Kazakhstan (NBK) | 420 | 53 |

(Source: IMF IFS, World Gold Council, national central-bank disclosures, October 2025 estimates)

Why the Pivot

- Fiscal Strain. U.S. debt-to-GDP near 130 percent and persistent deficits above 6 percent have weakened the perception of Treasuries as risk-free assets.

- Financial Sanctions. Asset freezes on Russia, Iran, and others have highlighted the vulnerability of fiat reserves to policy decisions.

- De-Dollarization. BRICS and Middle Eastern institutions have raised gold allocations to 15–20 percent of reserves, up from around 10 percent in 2020.

Treasuries’ Waning Crown

The $28 trillion Treasury market remains the cornerstone of global liquidity, but its relative appeal has diminished. Real yields hover near zero after successive Federal Reserve rate cuts, while recurring debt-ceiling disputes and political gridlock have introduced new uncertainty.

Foreign central banks’ share of Treasuries has fallen below 30 percent of reserves, reducing external demand and contributing to upward pressure on yields. At the same time, gold’s role as top-tier collateral in repo and swap markets has grown steadily, according to BIS data.

The Institutional Shift

This reweighting of reserves is not a temporary reaction to price movements. It reflects a strategic reassessment of duration risk, credit exposure, and geopolitical neutrality. The modern reserve portfolio is evolving from a singular dependence on dollar-denominated instruments toward a mixed composition of gold, multiple currencies, and—gradually—regional sovereign debt.

For policymakers, the move provides insulation from volatility in Western bond markets. For investors, it signals that the era of treating U.S. Treasuries as the universal hedge may be ending.

Market Implications

- Higher Floor for Gold. Persistent official demand, averaging about 1,000 tonnes a year, establishes a durable base for prices even in periods of ETF outflows.

- Funding Costs. Reduced foreign participation in Treasury auctions could add upward pressure of 25–50 basis points to long-term yields, according to sell-side estimates.

- Broader Commodity Effects. The same diversification logic is lifting interest in silver, platinum, and strategic energy reserves as central banks seek inflation-resilient stores of value.

A System in Transition

The milestone where gold reserves surpass Treasuries is more than a statistical anomaly. It represents a gradual recalibration of trust within the global monetary system. While the dollar’s dominance endures, its exclusivity no longer does.

Central banks are not abandoning U.S. assets, but they are broadening the definition of safety to include assets that stand outside the political and fiscal dynamics of any single nation.

Be First to Comment