Container freight rates are soaring due to tensions between Israel and Iran, raising fears of a Strait of Hormuz closure. This, along with Red Sea disruptions, is boosting shipping costs, creating a golden opportunity for Euroseas Ltd. (NASDAQ: ESEA – $42.58) and Danaos Corporation (NYSE: DAC – $89.19). With modern fleets and strong contracts, these companies are set to profit from the rate surge.

Freight Rates Soar Amid Geopolitical Tensions

Fears of Iran closing the Strait of Hormuz, a key route for 20% of global oil and container traffic, have spiked shipping costs. Israel’s recent attacks on Iran and Iran’s missile response have led some shippers to avoid the Strait, increasing transit times and rates. Houthi attacks in the Red Sea also force rerouting around Africa, tightening container supply.

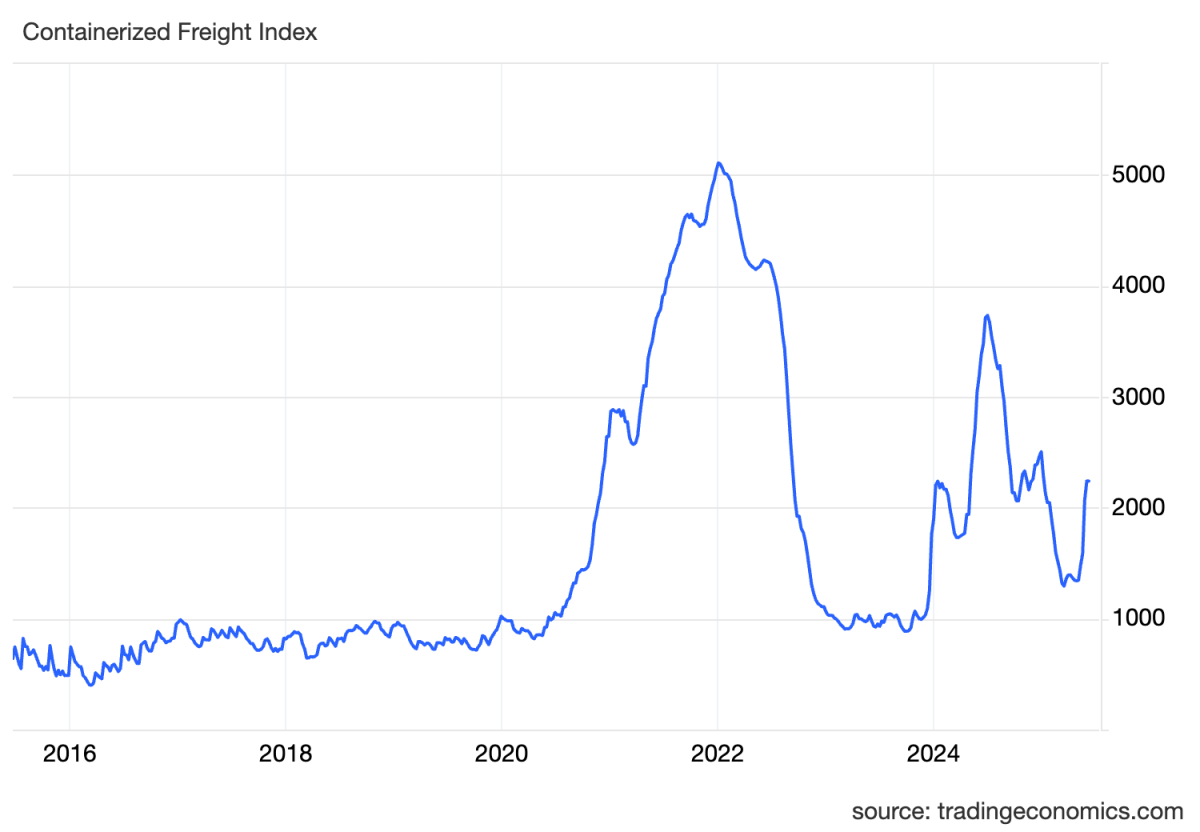

The Freightos Baltic Index (FBX) reports global freight rates at 2,240.35 points for a 40-foot container (FEU) as of June 13, 2025, up 66.55% from last month.. The Shanghai Containerized Freight Index (SCFI) shows spot rates at $4,500 per TEU, a 115% jump from pre-pandemic averages and more than double 2023’s average, though down 45% from 2024’s peak. Specific routes like Shanghai to South America hit $9,026 per TEU in mid-2024, while Shanghai to West Africa reached $5,563 per TEU.

Euroseas Ltd.: Cashing In on High Rates

Euroseas operates 22 containerships with 72,673 TEU capacity. It’s modernizing its fleet, adding seven new vessels since 2023 and four more by 2027. Charters covering 94% of 2025 capacity lock in high rates, like $35,500 per day for M/V Synergy Antwerp, generating $57 million in EBITDA. Q4 2024 revenues rose 8.7% to $53.3 million, with a yearly profit of $112.8 million.

ESEA trades at $43.61, with a forward P/E of 2.62 (industry: 6.60) and a price-to-book of 0.98 (industry: 1.43). Its shares are up 48% YTD.

Danaos Corporation: Steady and Profitable

Danaos runs 73 containerships and 10 dry bulk vessels, with a $3.4 billion charter backlog ensuring earnings through 2026. It added six new ships in 2024 and one in 2025, with 15 more by 2028. Q4 2024 revenues hit $258.2 million, up 3.6%, with projected EPS above $25 through 2026. Its dry bulk stake, including 16.7% of Eagle Bulk Shipping, adds stability. DAC’s trailing P/E is 2.93, and its shares are up 11.3% YTD.

Risks to Watch

If Israel-Iran tensions ease or the Red Sea stabilizes, rates could drop. Economic slowdowns or tariffs may hurt demand. Euroseas’ cash flow is strained by fleet investments, and Danaos’ high insider ownership (48%) raises governance concerns.

The Bottom Line

With freight rates up 66.55% month-over-month per the FBX and 115% above pre-pandemic levels per the SCFI, Euroseas and Danaos are thriving. Euroseas’ high-rate charters and low valuation offer growth, while Danaos’ steady contracts and expansion ensure profits. Both are top picks for investors eyeing the shipping boom.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Investors should conduct their own research and consult with a financial advisor before making investment decisions.

Be First to Comment